75% LTV loan for Investment Properties SIVA 1-4 units and Apartments

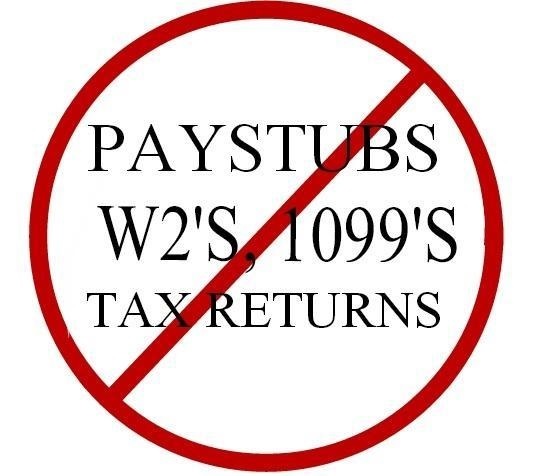

75% LTV loan for Investment Properties SIVA 1-4 units and Apartments See rate flyer below. Low fico OK. Loan amounts will be from $75K to $5,000,000. Need 1003, credit report, 3 months complete bank statements all pages, Need to show 4 months reserves which can be an unseasoned gift, No personal financials, and your choice fund as individual or Corp. Choose a loan term 12 months to 4 years. I/O payment. For loans outside of California add 1% to the rate. 75% LTV loan for Investment Properties SIVA 1-4 units and Apartments. Non owner investment loan only. CA, AZ, WA, TX, Oreg, CO, UT & FL only properties. Our loan products allow borrowers to simply state their monthly income on a mortgage application instead of verifying the actual amount by furnishing pay stubs or tax returns. This simplified method is intended for self-employed borrowers with complicated tax schedules. This loan has become more widespread, often because borrowers find this much easier to qualify for a loan by stating their income. See rate sheet and specific loan application below. *************Flyer for Titanium Loan ************* List of Forms & Documents Required: 3 months complete bank/financial statements (to show 4 months reserves – no seasoning okay) Declaration of Non-Owner Occupancy form Link to Document Letter of Experience form Letter of Experience Photocopy of valid ID Purchase Transactions – fully executed purchase contract Refinance Transactions – mortgage statement Insurance declaration page/quote for coverage 1003 Loan Application – use this printed 1003. Credit report we will pull or if broker submitted need full 3 bureau Borrower authorization Borrower’s Authorization Borrower authorization To Wire Funds Authorization to Wire Funds Borrower authorization to run and pay for credit Credit & Appraisal $$ Authorization Form SI form – Statement of Information SI Form – Statement of Information If and only if needs: Is property is leased – provide lease agreements Title to be held in Corporation/LLC Articles of Organization/Incorporation – Operating Agreement/Bylaws – need these supporting documents Property will require rehab, provide construction bid/plans (recently repaired supply list of repairs made) Property is leased and is more than 1 unit, nee rent roll Schedule of Real Estate Owned **To expedite your file organize bank statements separated by month in adobe format “.pdf”. 3 loan choices – 1st Choice the 1 year loan – Interest only payments for 12 month term with a balloon payment due at the end of the term. 2nd Choice – 2 year loan – Interest only payment for 24 month term with a balloon payment due at the end of the term. This loan has a minimum period of 15 months interest to be collected. 3rd Choice – 4 year loan – Interest only payment for 48 months term with a balloon payment due at the end of the term. This loan has a minimum period of 24 months interest to be collected. 75% LTV loan for Investment Properties SIVA 1-4 units and...

read moreSelf-Employed Bank Statement Loan

2 Bank Statements only for owner and non owner properties. 4.75% note rate. SIVA at 70% LTV. Loan package is easy alternate doc with 2 months personal banks statements (No biz bank stmts. Min fico score 700 to 719 at 65% or 70% LTV with 720+ fico. 30 YEAR Loan for owner occupied, Second Home and Investment properties 2-4 units okay. 70% LTV for non owner 2 to 4 units. Minimum loan amount $100k. $625k to $1mm is at 60% LTV. Max dti 43%. Max Loan amount $2,000,000. Max cash out $500,000. No tax returns. No W2s. No 1099s. Gift funds okay for half the down payment. Need unaudited YTD P&L and last years P&L. There is a hit to the rate .25 for non owner, and or .25 for cash out but no change in LTV. What you need is the require down payment, closing costs – title & escrow fees, 2.25% point loan cost, and 12 months PI in verified liquid reserves. Borrowers who own additional rental properties must have 6 months PI for each additional financed property. See guidelines for specifics. CA only properties. *******************Click on link for Hot Loan Product #1 Flyer for SFR, 4.75% with 2 month Bank Statement product ********************** A good example would be a borrower will always need at least 30% down. They will need 35% down if they have a fico score from 700-719. Only scores 720+ get 30% down. The reserves must be in a personal account too. They can use down payment money from either personal or business accounts of theirs. If it is a business account such as a corp or DBA they must be 100% owner of that account. See Flyer above for more details for Hot Loan Product #1. List of Forms & Documents Required: Photocopy of valid ID At least two bank statements to show the reserves required per the above flyer matrix (please read Flyer for SFR above) Current mortgage statement if refinance If purchase – need signed purchased contract. Need name and phone number of escrow contact. If property is leased, provide lease agreements If property is leased and is more than 1 unit, rent roll Schedule of Real Estate Owned Insurance declaration page/quote for coverage 1003 Loan Application – use printed 1003. Credit report we will pull or if broker submitted need full 3 bureau Borrower authorization Borrower’s Authorization Borrower authorization to run and pay for credit Credit & Appraisal $$ Authorization Form Borrower authorization To Wire Funds Authorization to Wire Funds SI form – Statement of Information SI Form – Statement of Information **To expedite your file organize bank statements separated by month in adobe format “.pdf”. <a href=”https://www.secureloandocs.com/apply.php?id=26639789″><img src=”https://www.secureloandocs.com/images/buttons/button1.gif” width=”90″ height=”40″...

read moreOwner Occupied Bail Out Loan

A foreclosure bailout may be a refinance transaction when the true purpose of the loan is to bail out the property owner from an existing property and lien that is in foreclosure. We offer a strict owner occupied bail out loan for this purpose. The term is no more than 12 months with the intention to sell. A bailout is a colloquial term for giving financial support to a company or country which…

read moreFast Cash Business Loans

We offer Fast Cash Business Loans. This is a quick and easy process and most all businesses qualify as long as they have been in business for at least 6 months. Fill out the esy one page application. Funding is in about 10 days. These business loans are not tied to real estate and do not require tax returns. We are NOT looking at net profit. The more positive and consistent the cash flow, the…

read moreStated Income Self Employed Loans 2016

The number one loan for self employed borrowers was our Stated Income Self Employed Loan. These loans give the self employed borrowers the ability to buy properties that they could not have with a traditional bank. Self Employed Loan we keep our process simple and much faster than traditional lenders. We use our make sense lending guidelines for our self employed borrowers. We understand self.

read more