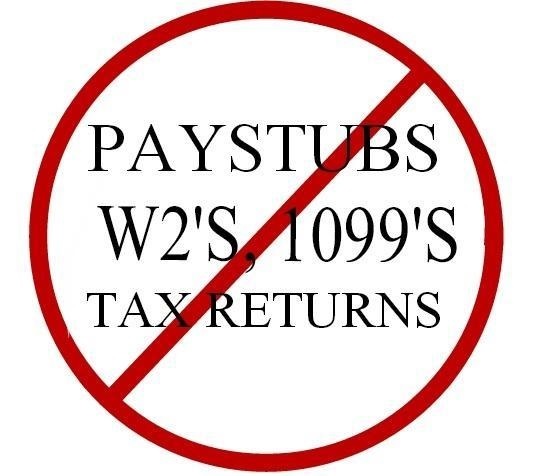

Purchase Loans For Self Employed persons

Purchase Loans For Self Employed persons. Need 24 months personal bank statements.

If you are in California – you may qualify for the 1% discount on the rate. Just ask for it.

Short Sales, Previous BK, Foreclosure, & Modified OK

All percentage hits below are to the rate.

Special Notes:

- No Prepayment Penalty.

- 55% DTI okay.

- Personal Bank statements only. Provide all pages. Can only use one account statement to cover the 24 month period, if a previous account was closed, need the last zero balance statement and the first statement of the new account.

- We look at 100% of the deposits as income. Do not count returns or transfers**

- **We will count transfers from your business account to personal account. Then you will need to show that particular business bank statement from that month it was transferred from.

- No buy downs.

- No reserves unless over 75% LTV.

- We only use Trans-union score for this particular loan product. For husband and wife we add the 2 scores and divide by two for pricing on our matrix.

- For TERMS 10 years is 10/10 as a 30 year is 30/30 amortization.

- Cost is 3% points plus $1,625

- Brokers can make 50 basis points on the loan amount.

- This Loan Program available NATIONWIDE.

List of Forms & Documents Required:

- 24 months complete bank/financial statements Click Here For Borrower Worksheet / Log of 24 months bank statements

- For the 24 months of statements mark each deposit on each page that is income and Complete Bank Statement Income Questionnaire

- Photocopy of valid ID

- Purchase Transactions – fully executed purchase contract

- Refinance Transactions – mortgage statement

- If property is leased, provide lease agreements

- Insurance declaration page/quote for coverage

- Business license – ie: state – federal – city business license for 2 years – if self employed

- CPA letter or can be a licensed tax preparer letter – that they been in biz for 2 years

- 1003 Loan Application – printed 1003.

- Credit report we will pull

- Borrower authorization Borrower’s Authorization

- Borrower authorization to run and pay for credit & appraisal Credit & Appraisal $$ Authorization Form

- Borrower authorization To Wire Funds Authorization to Wire Funds

- SI form – Statement of Information SI Form – Statement of Information

**To expedite your file organize bank statements separated by month in adobe format “.pdf”.

Any rates and terms stated above are for professional real estate mortgage brokers and bankers only. Rates, terms and procedures subject to change daily. This website, links and any attachments, contains information that is private to Equity Development and its clients and is to be considered under the privacy laws, and is also confidential and proprietary in nature. Thank you in advance for your cooperation.

**** Do you want more choices of stated income loans and no doc loans check out our other website at http://juststatedincomeloans.com/hot-loan-products ****