Purchase Loans – Using Assets Depletion Only AKA Liquid Asset Funding

Loan is available in all 50 states

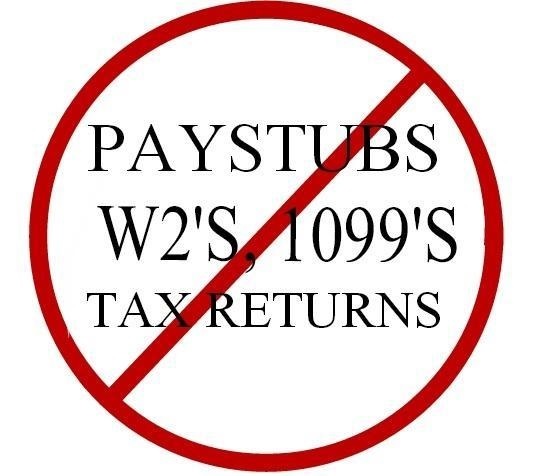

Our Asset depletion is a little different method of calculation compared to other lending institutions. We take the loan amount plus the closing costs as the needed assets to be shown. With this loan product no income is stated, and no debt to income ratios. The borrower is not required to cash in their assets as they’re only used to demonstrate an ability to make the mortgage and housing payments.

Loans are available from $75,000 to $6,000,000.

For example a large purchase of $900,000 would require 25% down. The new loan would be $675,000 = 75% LTV. For this specific loan program – no tax returns and no 24 months statements. Borrower would need to have in their account after the down payment the loan amount of $675,000 plus what ever the closing costs are.

Smaller loam amount 400,000 and below can put as little as 20% down. If you are in California it may be as low as 10-15% down.

Borrower will need a 579+ credit score.

The rates are the same as our LOAN PROGRAMS in the drop down menu above.

Asset rich individuals who are unable to provide a qualifying employment history or sufficient income may find this as an ideal solution. However, not all loan programs allow asset depletion as an acceptable income source. Please call us today to learn more about asset depletion and determine whether this method will work for your specific transaction.